“Habits form your destiny.”

Suzy Orman

Thought I’d take a chance and be vulnerable. Share.

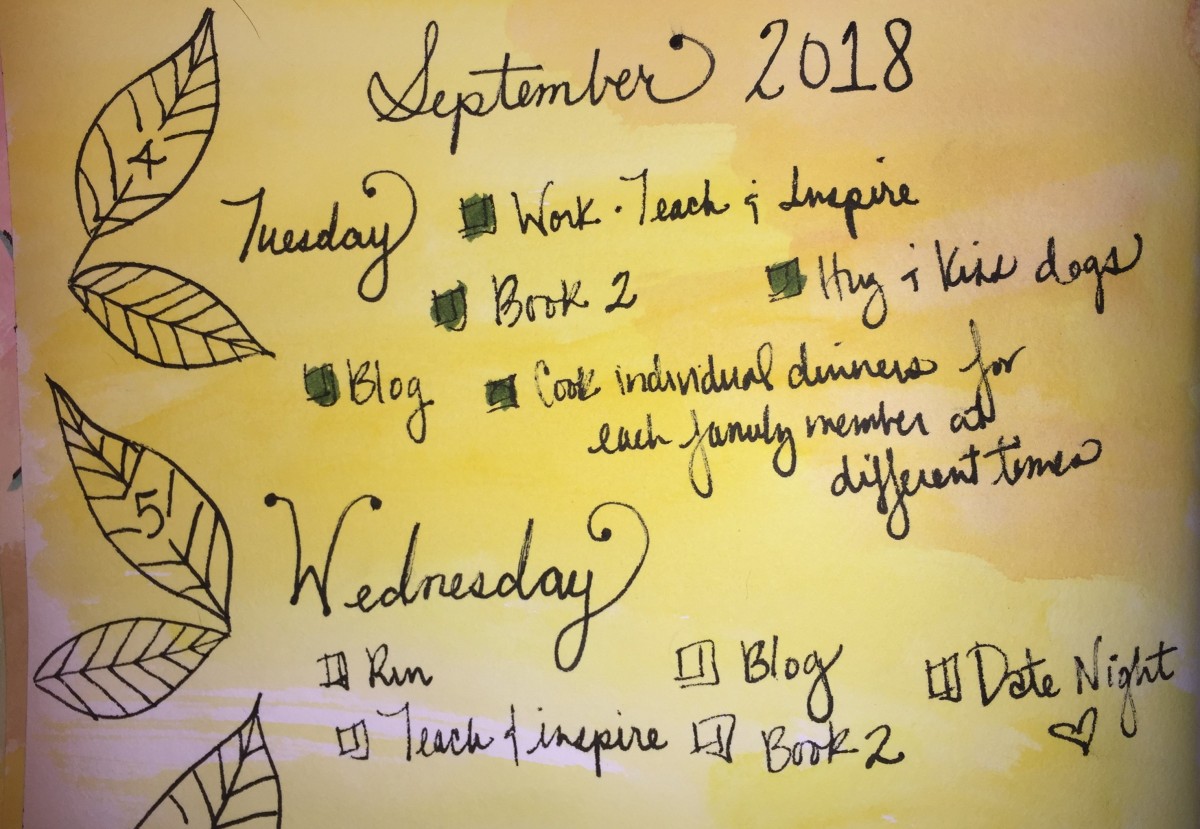

Above, my journal entry for yesterday and today.

Below, my financial tips that have helped my husband and me reach our goal of $1,000,000.

I know it’s totally taboo in America to talk about salary and net worth. But I really want to help people who struggle with money.

I’m a teacher, for Pete’s sakes.

I don’t make a lot, but I also don’t spend a lot. I started my career in radio and I made $17,000 a year. I ate pasta for breakfast, lunch and dinner until I developed a food allergy. Of course, I was unable to save for retirement during that time. I don’t have regrets: I met Gloria Steinem (she’s a goddess!), the lead singer of Simply Red (he was a jerk) and Lou Diamond Phillips (swoon)! I befriended Steve, our Program Director, who encouraged me to be a writer. So, I don’t regret that year, but it was an entire year that I did not save or invest money.

My next job: administrative assistant in a money managing firm. Wow, did I learn a lot. I learned about stocks and investing and I started my 401K.

There are two things I recommend you do ASAP:

If you can, find an excellent financial advisor. We did this and I attribute much of our success and wealth to him. You’ll need to do research and be financially savvy. NEVER simply hand over your finances to someone. ALWAYS know what is going on with your money! And don’t be shy about telling him/her what you want to sell and what you want to purchase.

Owe Vs. Own

Guess which one you want to grow?

Maybe you have a lot of debt. Maybe you have no debt but very little savings. Whatever you dream for yourself, you can do it! Just make a plan and begin.

Just got my paycheck stub.

Who the heck is FICA and why am I paying him so much?

*Taxman from The Beatles

Feeling stressed and anxious about the holidays is a choice. Yes, it is.

Don’t succumb to the pressure to buy.

“This year, shoppers plan on spending $660 on average for the holiday season. 27% report they did not create a budget at all and 24% say they overspent last year.” (USA Today)

Create a budget. Stick to it. If anyone has a problem with it, it’s exactly that – their problem.

Focus, instead, on expressing love for friends and family. Be kind to yourself. Be kind to others. That is the true spirit of the holidays, no matter what your faith.

Here is an interesting graphic from USA Today: