You are on the right track if:

- you can lose your job and still remain calm,

- have your graduation or wedding postponed and you’re still happy,

- you choose people over money,

- remember that this, too, shall pass

You are on the right track if:

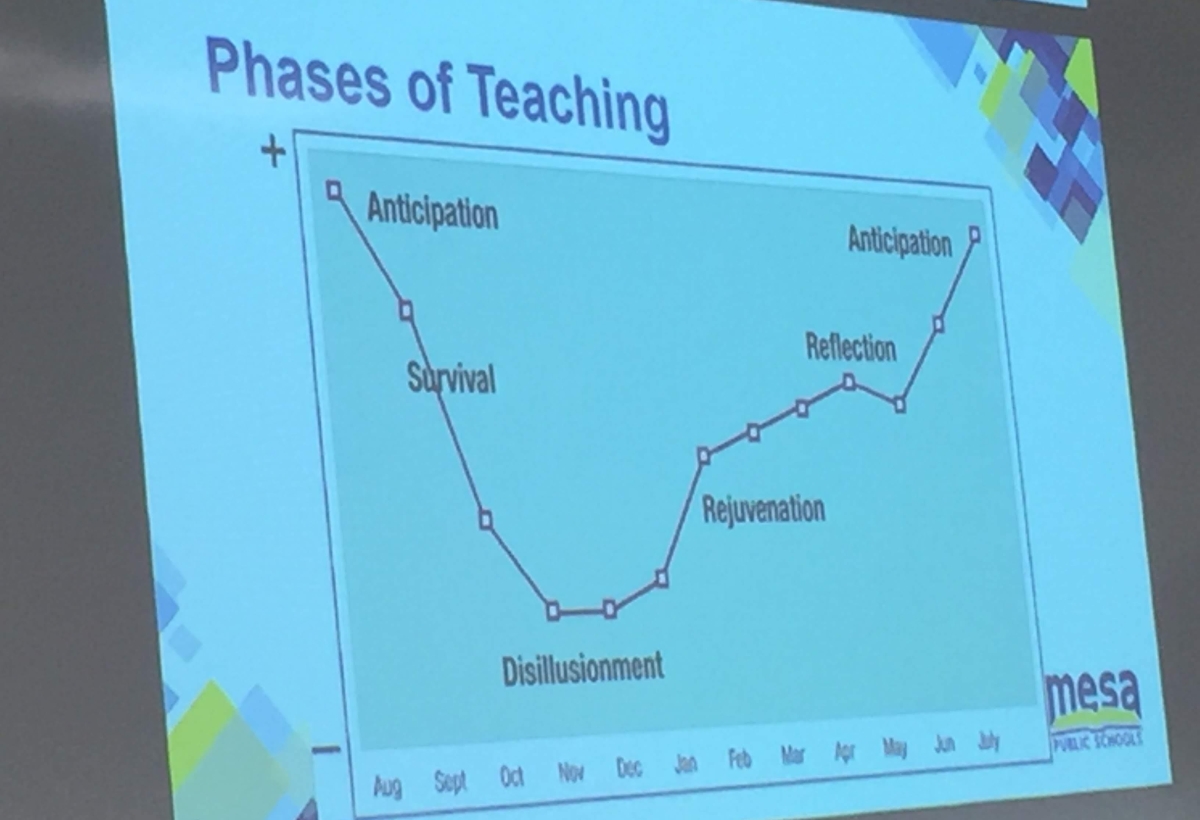

“Public School Teacher Attrition and Mobility in the First Five Years,” found that 10 percent of new teachers in 2007-08 didn’t return the following year, increasing cumulatively to 12 percent in year three, 15 percent in year four and 17 percent in the fifth year. The totals include teachers who were let go and subsequently didn’t find a job teaching in another district.

“Two important findings support what NEA has advocated for a long time. That high-quality mentors and competitive salaries make a difference in keeping teachers,” said Segun Eubanks, director for Teacher Quality at the National Education Association.

Data from edsource.org

Thought I’d take a chance and be vulnerable. Share.

Above, my journal entry for yesterday and today.

Below, my financial tips that have helped my husband and me reach our goal of $1,000,000.

I know it’s totally taboo in America to talk about salary and net worth. But I really want to help people who struggle with money.

I’m a teacher, for Pete’s sakes.

I don’t make a lot, but I also don’t spend a lot. I started my career in radio and I made $17,000 a year. I ate pasta for breakfast, lunch and dinner until I developed a food allergy. Of course, I was unable to save for retirement during that time. I don’t have regrets: I met Gloria Steinem (she’s a goddess!), the lead singer of Simply Red (he was a jerk) and Lou Diamond Phillips (swoon)! I befriended Steve, our Program Director, who encouraged me to be a writer. So, I don’t regret that year, but it was an entire year that I did not save or invest money.

My next job: administrative assistant in a money managing firm. Wow, did I learn a lot. I learned about stocks and investing and I started my 401K.

There are two things I recommend you do ASAP:

If you can, find an excellent financial advisor. We did this and I attribute much of our success and wealth to him. You’ll need to do research and be financially savvy. NEVER simply hand over your finances to someone. ALWAYS know what is going on with your money! And don’t be shy about telling him/her what you want to sell and what you want to purchase.

Owe Vs. Own

Guess which one you want to grow?

Maybe you have a lot of debt. Maybe you have no debt but very little savings. Whatever you dream for yourself, you can do it! Just make a plan and begin.

I attended a workshop on educational leadership today. I walked away with lots of good stuff but one quote that stuck with me was:

Get what you want. Find a way.

Being a leader means helping others lead, really. Supporting others to be the best they can be is one of the biggest objectives and one of the most challenging. One vital channel to this goal is to make others feel appreciated and help them in their jobs.

Make your staff feel valued by obtaining resources that they need or want for their work. Show them that you appreciate what they do and that you consider it important. “Get what you want. Find a way.”

This is really the secret to success, isn’t it? What do you want? How can you find a way to get it?

I laugh a lot all day while I work.

Kids say the funniest things. There are entire shows and books about the humor of children. As a teacher, I also get a lot of hugs. AND, I really like the other teachers, my co-workers. We laugh a lot together. This job is pretty awesome.

Many years ago, I had a position in a money management firm where the “COO” (Chief Operating Officer, or soft murmuring sound made by a pigeon – (you choose)) walked briskly from his office to my cubicle and told me, “You are laughing too much and too loudly.” And then he stomped back to his office with a grand view of the San Francisco Bay. He made a lot of money. He died a couple years ago. I hope he laughed before he went.

I’ve held other jobs where I didn’t laugh all day. Isn’t that sad? I mean, it would have been inappropriate – unprofessional – to do so. The guys in suits, taking themselves so seriously and looking down at you for being….happy you.

You know what? It’s them, not you. You’re not too loud, or too happy. You’re not unprofessional (unless you’re taking lots of cigarette breaks, or calling in sick all the time, or just not doing your job). You are fine just the way you are. If your boss doesn’t like you, or if you’re unhappy, you might consider changing your job.

Just sayin’.

“An act of devoting time, effort, or energy to a particular undertaking with the expectation of a worthwhile result.” Dictionary.com

We don’t hesitate to put a portion of our income into investment vehicles because we have faith that making the sacrifice will pay off in the future.

We don’t hesitate to enroll our children in music or sports because we know that the payoff will be great.

We don’t hesitate to support our spouses by cooking healthy meals, lending an ear and giving words of encouragement.

But…

When it comes to paying tuition, taking the courses for a degree or going for that dream job, mothers tend to look at the cost to the family and consider it too “expensive.” They say, “Not now, it’s not the right time.” Moms often don’t look at it as investment for the self.

I was talking to a good friend of mine who told me about her “dream job.” This job is just one rung away. She’s hard-working, super smart and talented. She just needs to take a test and pass it. Taking the test costs a fee. “Well, I think I should wait until the job becomes vacant. Then I’ll take the test. I don’t know that it’s a wise use of money right now.”

What?

Have you ever heard a man say that?

Invest in yourself. It’s not selfish. It’s your obligation.